The Serious Consequences of Bad Bookkeeping on Your Small Business

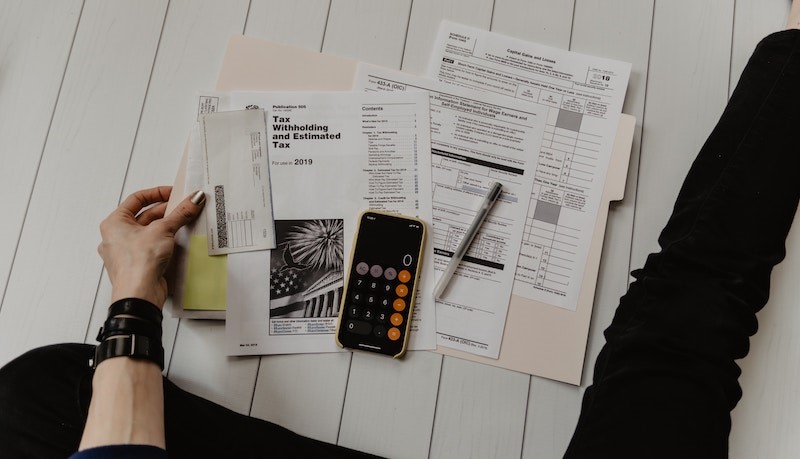

There are many things that you need to worry about as a small business owner. Not only are you evaluating cash flow to make sure that you have enough money for payroll, but you are also carrying the burden of overseeing employee management, budgeting, business development, customer service, marketing, and more. These responsibilities can add up, making it easy for important tasks to slip through the cracks. Certain tasks can be handed in the future, but don’t procrastinate financial matters resulting in a situation where you are facing bad bookkeeping practices.

It is essential that you are tracking the money that is coming in and going out so that you have detailed information for tax filings, profit and loss reports, and more. Without the right financial tracking, you are setting your business up for failure.

Whether you are an entrepreneur who is just starting up or a small business owner who has been chugging along for a while, nothing is more important than separating your business and personal finances.

Whether you are an entrepreneur who is just starting up or a small business owner who has been chugging along for a while, nothing is more important than separating your business and personal finances.

Why should business owners be concerned about keeping these finances separate? Legal liability, ease of bookkeeping, and personal asset protection are just a few reasons to separate your personal cash from your business dealings.

Tax Implications

Perhaps the most important reason to separate personal and business finances is for tax purposes. As a business owner, you can deduct business-related expenses like travel and supplies. To claim these deductions, you must have proper supporting documentation.

If your business is audited by the IRS, they will look closely at every expense to verify it is actually related to your business operation. Having a separate business account with a clear paper trail of expenses and how you paid for them will make this process so much simpler.

There are several reasons business owners should consider hiring a business consultant. Business Consultants bring their experience and expertise to helping businesses maximize their potential and avoid pitfalls. Some business consulting services include:

There are several reasons business owners should consider hiring a business consultant. Business Consultants bring their experience and expertise to helping businesses maximize their potential and avoid pitfalls. Some business consulting services include:

- Providing expertise in a specific market

- Identifying problems

- Supplementing existing staff

- Initiating change

- Providing objectivity

- Teaching and training employees

- Doing the "dirty work," like eliminating staff

- Reviving an organization

- Creating a new business

Consider a scenario where your startup is on its way from idea to formal business. There are many, many things to think about and consider.

Consider a scenario where your startup is on its way from idea to formal business. There are many, many things to think about and consider.

And one of them may just include that all-important decision of when to bring in outside experts to assist you with some of the operational functions that go into running a business.

Those functions almost certainly include the financial aspect of your business. While you may not need -- or want -- an accountant, you could at least consider a bookkeeper to help with the various financial aspects. Your only other alternative is to become a bookkeeper yourself so that you understand every aspect of your business! And that's just not realistic.